Q: | Where can I find the voting results of the meeting? |

A: | The preliminary voting results will be announced at the meeting. The final results will be published in a current report on Form 8-K to be filed by us with the SEC within four business days of the meeting. |

Proposal 1

ELECTION OF DIRECTORS

At the meeting, threefour directors are to be elected. Each director is to hold office until the next annual meeting of stockholders or until his successor is elected and qualified. After identifying the members of our Board of Directors who are up for re-election in 2018fiscal year 2022 and reviewing the criteria that the Nominating and Governance Committee uses when evaluating director nominees, the Board of Directors nominated the threefour directors for election at the meeting based on the recommendation of the Nominating and Governance Committee. All of the director nominees are already serving as members of the Board of Directors of the Company.

In considering individual director nominees and Board of Directors committee appointments, our Nominating and Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board of Directors and Boardits committees and to identify individuals who can effectively assist the Company in achieving our short-term and long-term goals, protecting our stockholders’ interests and creating and enhancing value for our stockholders. In so doing, the Nominating and Governance Committee considers a person’s diversity attributes (e.g., professional experiences, skills, background, race and gender) as a whole and does not necessarily attribute any greater weight to one attribute. Moreover, diversity in professional experience, skills and background, and diversity in race and gender, are just a few of the attributes that the Nominating and Governance Committee takes into account. In evaluating prospective candidates, the Nominating and Governance Committee also considers whether the individual has personal and professional integrity, good business judgment and relevant experience and skills, and whether such individual is willing and able to commit the time necessary for service on the Board of Directors and Board committee service.its committees.

While there are no specific minimum requirements that the Nominating and Governance Committee believes must be met by a prospective director nominee, the Nominating and Governance Committee does believe that director nominees should possess personal and professional integrity, have good business judgment, have relevant experience and skills, and be willing and able to commit the necessary time for service on the Board of Directors and Board committee service.its committees. Furthermore, the Nominating and Governance Committee evaluates each individual in the context of the Board of Directors as a whole, with the objective of recommending individuals that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound business judgment using their diversity of experience in various areas. We believe our current directors possess diverse professional experiences, skills and backgrounds, in addition to (among other characteristics) high standards of personal and professional ethics, proven records of success in their respective fields and valuable knowledge of our business and our industry.

| 8 |

| Table of Contents |

Nominees

The following table and accompanying descriptions indicate the name of each director nominee, including their age, principal occupation or employment, and the year in which each person first became an officer or director.

Name | Position | Date First Elected/Appointed as | Age | |||

James A. Doris | Chief Executive Officer and Director | December 23, 2020 | 49 | |||

Fred Zeidman | Director | January 11, 2018 | 74 | |||

James G. Miller | Director | July 10, 2018 | 73 | |||

Robert K. Green | Director | December 23, 2020 | 59 |

Directors

RICHARD N. AZAR II, InterimDirectors

James A. Doris, Chief Executive Officer And Director

Mr. Doris was appointed as Chief Executive Officer and Director

Mr. Azar served as Chairman of the Board from August 2016 to May 2017,of Directors for the Company on December 23, 2020 in conjunction with the acquisition of Viking Energy Group, Inc. (“Viking”) by the Company. He has been an officer and director of Viking since 2014 and has continuedbeen an integral part of transitioning the Company’s to an appropriate platform to facilitate growth. He has over 25 years of experience negotiating national and international business transactions. Formerly a lawyer in Canada, Mr. Doris represented domestic and foreign clients regarding their investment activities in Canada for over 16 years. Prior to starting his own law firm, Mr. Doris served as Executive Vice President and In-House Counsel for a real estate investment and development company as well as working at one of Canada’s leading law firms. Mr. Doris graduated cum laude from the University of Ottawa.

Director Qualifications:

The Board of Directors believes that Mr. Doris is highly qualified to serve as a member of the Board of Directors after he stepped down as Chairman. Since June 28, 2017,due to his extensive experience in the energy sector, including oil and gas industry, and negotiating business transactions.

Fred S. Zeidman, Director

From December 2014 to February 2021, Mr. Azar hasZeidman served as SecretaryChairman of Gordian Group LLC, a U.S. investment bank specializing in board level advice in complex, distressed or “story” financial matters. Mr. Zeidman currently serves as Director of External Affairs of MCNA Dental, lead Director of Straight Path Communications, Inc., Director REMA and Director Prosperity Bank in Houston. He was formerly Restructuring Officer of TransMeridian Exploration Inc. and Chief Bankruptcy Trustee of AremisSoft Corp.

| 9 |

| Table of Contents |

Mr. Zeidman, Chairman Emeritus of the United States Holocaust Memorial Council was appointed by President George W. Bush in March 2002 and served in that position from 2002-2010. A prominent Houston based business and civic leader, Mr. Zeidman also is Chairman Emeritus of the University of Texas Health Science System Houston and Director and Chief Financial Officer of the Texas Heart Institute. He is on the board of the Development Corp of Israel (Israel Bonds) and served on the Board of the National World War II Museum.

Over the course of his distinguished 50 year career, Mr. Zeidman has been involved in numerous high-profile workouts, restructurings and reorganizations. He was the former CEO, President and Chairman of Seitel, Inc., a Houston-based onshore seismic data provider where he was instrumental in the successful turnaround of the Company. On June 2, 2017, Mr. Richard N. Azar II was appointed as Interim Chief Executive OfficerHe held the post of Chairman of the Company. Board and CEO of Unibar Corporation, the largest domestic independent drilling fluids company, until its sale to Anchor Drilling Fluids in 1992.

Mr. AzarZeidman holds a Bachelor’s degree from Washington University in St. Louis and a Master’s in Business Administration from New York University.

Director Qualifications:

The Board of Directors believes that Mr. Zeidman is an executive withinhighly qualified to serve as a member of the Board of Directors due to his significant experience serving as a director of public and private companies and institutions and his substantial understanding of the oil and gas industry with more than 30 years’ experience in general.

James G. Miller, Director

Mr. Miller is a retired corporate executive, having served as president and CEO of several energy companies. He has previously served on the Board of Directors of companies listed on NYSE, NASDAQ and the Australian Stock Exchange. From 2009 until 2016, Mr. Miller served as a Director of Guardian 8 Holdings. From December 31, 2010 through March 2018, he was a Director of Enerjex Resources, Inc. (NYSE American), an oil and gas exploration and production sector. Mr. Azar serves as President/Co-Founder of San Antonio-based Brittany Energy, LLCcompany, and Sezar Energy, LP, independent oil and gas exploration and production companies.chaired the Audit Committee. In addition, he wasMarch 2018, Enerjex executed a director with Petroflow Energy, Ltd./TexOakPetro Holdings, LLC., a private oil and gas company with operations in the Hunton dewatering resource play in Oklahoma. Since 1982, Mr. Azar’s companies have explored for, produced and operated over 1,000 wells in Central, South and West Texas and Central Oklahoma, including the development of the Hunton Dewatering Resource play in central Oklahoma.merger which concluded his Board service.

Mr. Azar co-founded San Antonio Gas & Oil (SAGO), which in 1985 acquired Altex Resources, Inc., a leading oil and gas exploration company. Over the last 20 years, Mr. Azar has been instrumental in developing a Hunton Dewatering Resource play in central Oklahoma through his ownership/partnership in Altex Resources, Inc. Altex Resources was sold to a Canadian Energy Trust in March 2006. Mr. Azar remains active in the exploration of the Hunton Resource play. He currently serves as a Trustee for the San Antonio-based Texas Biomed Research Institute, has beenalso served on the Board of the Southwest BloodTrustees of The Nature Conservancy, Missouri Chapter, for 16 years and Tissue Center, and has actively participated in many philanthropic endeavors.is a past Board Chair.

Mr. Azar receivedMiller holds a Bachelor of Business Administration degreeBS in Electrical Engineering and an MBA in management from the University of Texas at Austin with distinguished military graduate honors.Wisconsin-Madison.

Director Qualifications:

Mr. Azar has extensive experience in the oil and natural gas industry and the business world in general. He also has extensive practical knowledgeThe Board of doing business in Texas and the United States. In addition, we believe Mr. Azar demonstrates personal and professional integrity, ability, judgment, and effectiveness in serving the long-term interests of the Company’s stockholders. As such, we believeDirectors believes that Mr. AzarMiller is highly qualified to serve as a director.member of the Board of Directors due to his experience having served as president and CEO of several energy companies and serving on the Board of Directors of several publicly-traded companies.

ROBERT SCHLEIZER, CHIEF FINANCIAL OFFICER AND DIRECTOR

| 10 |

| Table of Contents |

Mr. Schleizer, has over 30 yearsROBERT K. GREEN, DIRECTOR

Robert K. Green was appointed to the Board of financial and operational experience serving private and public companiesDirectors in financial and organization restructuring, crisis management, acquisitions and divestitures, and equity and debt financings across multiple industries. He is a co-founderconjunction with the acquisition of BlackBriar Advisors, LLC, a business renewal and acceleration firm, where he has served as Managing Partner since 2013. Prior to BlackBriar, Mr. Schleizer served as Chief Financial Officer and Director for Xponential, Inc., a public holding company that owned 34 specialty finance and retail stores, from 2001 to 2013, and as a Managing Director for BBK, an international financial advisory, where he provided restructuring and refinancing financial advisory services. Mr. Schleizer holds a Bachelor of Science in Accounting from Arizona State UniversityViking and is a Certified Insolvency Restructuring Advisor (CIRA)former Fortune 100 chief executive officer in the energy, telecommunication and Certified Turnaround Professional. Effective August 17, 2017,utility industries, and has extensive experience in capital markets, mergers and acquisitions, and regulatory and legislative strategies. Mr. SchleizerGreen has served on the boards of directors of seven publicly traded companies and was appointed as Interim Chief Financial Officerelected chairman of the board of two New York Stock Exchange (NYSE) companies and principal accounting/financial officerthree other publicly listed companies. He guided these companies and others in capital markets strategies involving initial public offerings (IPOs) and private investments with a combined value of Enerjex Resources, Inc.more than $5 billion and more than 50 merger, acquisition and divestiture transactions, some of which surpassed $1 billion. Mr. Green has been a Partner at the law firm Husch Blackwell since 2003.

Director Qualifications:

The Board of Directors believes that Mr. Schleizer has served as a director of many companies including oil and gas companies in the past and his financial expertise makes him an asset to the Company andGreen is highly qualified to serve as director of the Company.

DONNIE B. SEAY, DIRECTOR

Mr. Seay has been a self-employed investor over the last five years. Mr. Seay, is a 60 year veteran of the oil and gas industry and a former partner of Altex Resources, which developed the Hunton Limestone Play and drilled the first horizontal well there in southeast Oklahoma. Mr. Seay is also a former president of Guaranty State Bank and the founder and Chairmanmember of the Board of Citizens Bank, bothDirectors due to his experience having served as a CEO of New Braunfels, Texas.

Director Qualifications:a publicly-traded company and having served on the Board of Directors of several publicly-traded companies.

Mr. Seay’s thirty plus years in the oil and gas, his prior experience as a banker, as well as his experience with financial statements, brings tremendous experience to the Board, which we feel assists the Company and qualifies him to serve as a director.

Family Relationships

There are no family relationships among our directors or executive officers.

Arrangements between Officers and Directors

To our knowledge, there is no arrangement or understanding between any of our officers and any other person, including directors, pursuant to which the officer was selected to serve as an officer.

Pursuant to the December 30, 2015 Asset Purchase Agreement, the sellers of the property purchased by the Company in connection therewith had the right to appoint three members to the Board at the closing of the acquisition and exercised such right by requesting the appointment of Messrs. Richard N. Azar II, Alan Dreeben and Robert D. Tips to the Board (provided that Mr. Dreeben and Mr. Tips resigned from the Board effective October 6, 2017, which persons were appointed as members of the Board by the Board, pursuant to the power provided to the Board by the Bylaws of the Company, on August 26, 2016.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past ten years, none of our directors or executive officers were involved in any of the following: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being a named subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, (5) being the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of (i) any Federal or State securities or commodities law or regulation; (ii) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or (6) being the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”))Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

| 11 | ||

| Table of Contents |

Information Concerning the Board of Directors and its Committees

All directors hold office until the next annual meeting of stockholders and until their successors have been duly elected and qualified. There are no agreements with respect to the election of directors. We have historicallypreviously compensated our directors for service on the Board of Directors and committees thereof through the issuance of shares of common stock, stock options and cash compensation for meeting fees. Additionally, we reimburse directors for expenses incurred by them in connection with the attendance at meetings of the Board of Directors and any committee thereof (as described below). The Board of Directors appoints annually the executive officers of the Company and the executive officers serve at the discretion of the Board.Board of Directors.

The Board of Directors does not currently have a lead director. However, because of its capable and experienced independent directors and its strong committee system (as described more fully below), we believe this leadership structure is appropriate for the Company and allows the Board of Directors to maintain effective oversight and management and, therefore, a lead director is not necessary at this time.

Executive Sessions of the Board of Directors

The independent members of the Board of Directors of the Company meet in executive session (with no management directors or management present) from time to time, but at least once annually. The executive sessions include whatever topics the independent directors deem appropriate.

Risk Oversight

The Board of Directors exercises direct oversight of strategic risks to the Company. The Audit Committee reviews and assesses the Company’s processes to manage business and financial risk and financial reporting risk. It also reviews the Company’s policies for risk assessment and assesses steps management has taken to control significant risks. The Compensation Committee oversees risks relating to compensation programs and policies. In each case management periodically reports to our Board of Directors or relevant committee, which provides the relevant oversight on risk assessment and mitigation.

Policy Against Hedging

The Company does not currently have a policy against hedging.

Communicating with our Board of Directors

Stockholders may contact the Board of Directors about bona fide issues or questions about the Company by writing the Secretary at the following address: Attn: Secretary, Camber Energy, Inc., 404 Broadway,15915 Katy Freeway, Suite 425, San Antonio,450 Houston, Texas 77067.77094.

| 12 |

| Table of Contents |

Our Secretary, upon receipt of any communication other than one that is clearly marked “Confidential,“Confidential,” will note the date the communication was received, open the communication, make a copy of it for our files and promptly forward the communication to the director(s) to whom it is addressed. Upon receipt of any communication that is clearly marked “Confidential,“Confidential,” our Secretary will not open the communication, but will note the date the communication was received and promptly forward the communication to the director(s) to whom it is addressed. If the correspondence is not addressed to any particular Board member or members, the communication will be forwarded to a Board member to bring to the attention of the Board.Board of Directors.

Board and Committee Activity and Compensation

For the fiscal yearyears ending December 31, 2021 and March 31, 2017,2020, the Board hasof Directors held sixteen meetingstelephonic conferences and taken various other actionscorresponding via email as necessary, but held no formal meetings. All material decisions of the Board of Directors were evidenced via the unanimous written consent of the Board of Directors and the various committees described below. AllThough no formal meetings were held, all directors attended at least 75% of the Board of Directors meetings and committee meetings relating to the committees on which each director served.Directors’ telephonic conference. All of the then current directors attended our fiscal year 20172020 Annual ShareholderStockholder meeting held on March 22, 2017.11, 2020. The Company encourages, but does not require all directors to be present at annual meetings of shareholders.stockholders.

The Board of Directors has a standing Audit Committee, Compensation Committee, and Nominating and Governance Committee. Mr. Donnie B. Seay isMiller, Mr. Zeidman and Mr. Green are “independent” members of the only current “independent” member,Board of Directors as defined in Section 803(A) of the NYSE American Company Guide, of our Board.Guide. Committee membership and the functions of those committees are described below.

Board of Directors Committee Membership

C - Chairman of Committee.

M – Member.

Moving forward the Company plans to appoint additional independent director(s) and appoint such person(s) to the committees described above in order to meet applicable NYSE American listing requirements and rules which generally require that each of our committees have at least two members who are required to be independent members of the Board. We also plan to appoint committee chairpersons in the future.

Audit Committee | Compensation Committee | Nominating and Governance Committee | ||||

James A. Doris | ||||||

Robert K. Green | ||||||

Fred S. Zeidman | M | C | C | |||

James G. Miller | C | M | M | |||

C - Chairman of Committee. | ||||||

M - Member. |

Audit Committee

The Board of Directors has selected the member(s)members of the Audit Committee based on the Board’sBoard of Directors’ determination that the members are financially literate and qualified to monitor the performance of management and the independent auditors and to monitor our disclosures so that our disclosures fairly present our business, financial condition and results of operations.

| 13 |

| Table of Contents |

The Audit Committee’s function is to provide assistance to the Board of Directors in fulfilling the Board’sBoard of Directors’ oversight functions relating to the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the independent auditor’s qualifications and independence and the performance of the Company’s independent auditors, and perform such other activities consistent with its charter and our Bylaws (the “Bylaws”) as the Committee or the Board of Directors deems appropriate. The Audit Committee produces an annual report for inclusion in our proxy statement. The Audit Committee is directly responsible for the appointment, retention, compensation, oversight and evaluation of the work of the independent registered public accounting firm (including resolution of disagreements between our management and the independent registered public accounting firm regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. The Audit Committee shall review and pre-approve all audit services, and non-audit services that exceed a de minimis standard, to be provided to us by our independent registered public accounting firm. The Audit Committee carries out all functions required by the NYSE American (the “NYSE American”), the SEC and the federal securities laws.

The Audit Committee has the sole authority, at its discretion and at our expense, to retain, compensate, evaluate and terminate our independent auditors and to review, as it deems appropriate, the scope of our annual audits, our accounting policies and reporting practices, our system of internal controls, our compliance with policies regarding business conduct and other matters. In addition, the Audit Committee has the authority, at its discretion and at our expense, to retain special legal, accounting or other advisors to advise the Audit Committee.

The Board of Directors has determined that Mr. Seay isMiller, Mr. Zeidman and Mr. Green are “independent,” and that Mr. SeayMiller is an “audit committee financial expert” (as defined in the SEC rules) because he has the following attributes: (i) an understanding of generally accepted accounting principles in the United States of America (“GAAP”GAAP”) and financial statements; (ii) the ability to assess the general application of such principles in connection with accounting for estimates, accruals and reserves; (iii) experience analyzing and evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by our financial statements; (iv) an understanding of internal control over financial reporting; and (v) an understanding of audit committee functions. Mr. SeayMiller has acquired these attributes by means of having held various positions that provided relevant experience, as described in his biographical information above.

For the fiscal year ending MarchDecember 31, 2017,2021, the Audit Committee held four meetings.no formal meetings, but took various actions via a unanimous written consent of the committee. The Audit Committee’s charter is available on our website at www.camber.energy at “Governance” - “Policies” and was filed as Exhibit 14.3 to our Annual Report on Form 10-K/A for the year ended March 31, 2009, filed with the Commission on July 29, 2009.

Compensation Committee

The Compensation Committee is responsible for the administration of our stock compensation plans, approval, review and evaluation of the compensation arrangements for our executive officers and directors and oversees and advises the Board of Directors on the adoption of policies that govern the Company’s compensation and benefit programs. In addition, the Compensation Committee has the authority, at its discretion and at our expense, to retain advisors to advise the Compensation Committee. The Compensation Committee may delegate its authority to subcommittees of independent directors, as it deems appropriate.

For the fiscal year ending MarchDecember 31, 2017,2021, the Compensation Committee held no formal meetings. The Compensation Committee’s charter is available on our website at www.camber.energy at “Governance” - “Policies” and was filed as Exhibit 14.5 to our Annual Report on Form 10-K/A for the year ended March 31, 2009, filed with the Commission on July 29, 2009.

| 14 |

| Table of Contents |

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for (1) assisting the Board of Directors by identifying individuals qualified to become Board of Directors members; (2) recommending individuals to the Board of Directors for nomination as members of the Board of Directors and its committees; (3) leading the Board of Directors in its annual review of the Board’sBoard of Directors’ performance; (4) monitoring the attendance, preparation and participation of individual directors and to conduct a performance evaluation of each director prior to the time he or she is considered for re-nomination to the Board;Board of Directors; (5) reviewing and recommending to the Board of Directors responses to shareowner proposals; (6) monitoring and evaluating corporate governance issues and trends; (7) providing oversight of the corporate governance affairs of the Board of Directors and the Company, including consideration of the risk oversight responsibilities of the full Board and its committees; (8) assisting the Board of Directors in organizing itself to discharge its duties and responsibilities properly and effectively; and (9) assisting the Board of Directors in ensuring proper attention and effective response to stockholder concerns regarding corporate governance. We have not paid any third party a fee to assist in the process of identifying and evaluating candidates for director.

The Nominating and Governance Committee uses a variety of methods for identifying and evaluating director nominees. The Nominating and Governance Committee also regularly assesses the appropriate size of the Board of Directors and whether any vacancies on the Board of Directors are expected due to retirement or other circumstances. In addition, the Nominating and Governance Committee considers, from time to time, various potential candidates for directorships. Candidates may come to the attention of the Nominating and Governance Committee through current Board members, professional search firms, stockholders or other persons. These candidates may be evaluated at regular or special meetings of the Nominating and Governance Committee and may be considered at any point during the year.

The Nominating and Governance Committee evaluates director nominees at regular or special Committee meetings pursuant to the criteria described above and reviews qualified director nominees with the Board.Board of Directors. The Committee selects nominees that best suit the Board’sBoard of Directors’ current needs and recommends one or more of such individuals for election to the Board.Board of Directors.

The Nominating and Governance Committee will consider candidates recommended by stockholders, provided the names of such persons, accompanied by relevant biographical information, are properly submitted in writing to the Secretary of the Company in accordance with the manner described below. The Secretary will send properly submitted stockholder recommendations to the Committee. Individuals recommended by stockholders in accordance with these procedures will receive the same consideration received by individuals identified to the Committee through other means. The Committee also may, in its discretion, consider candidates otherwise recommended by stockholders without accompanying biographical information, if submitted in writing to the Secretary.

| 15 |

| Table of Contents |

In addition, the Company’s Bylaws permit stockholders to nominate directors at an annual meeting of stockholders or at a special meeting at which directors are to be elected in accordance with the notice of meeting pursuant to the requirements of the Company’s Bylaws and applicable NYSE American and SEC rules and regulations.

For the fiscal year ending March 31, 2017,2021, the Nominating and Governance Committee held no formal meetings, and took nobut did take various actions via thea unanimous written consent of the committee. The Nominating and Governance Committee’s charter is available on our website at www.camber.energy at “Governance” - “Policies” and was filed as Exhibit 99.2 to the Company’s Annual Report on Form 10-K for the year ended March 31, 2013, filed with the Commission on June 28, 2013.

Director Nominations Process. As described above, the Nominating and Governance Committee will consider qualified director candidates recommended in good faith by stockholders, provided those nominees meet the requirements of NYSE American and applicable federal securities law. The Nominating and Governance Committee’s evaluation of candidates recommended by stockholders does not differ materially from its evaluation of candidates recommended from other sources. Any stockholder wishing to recommend a nominee should submit the candidate’s name, credentials, contact information and his or her written consent to be considered as a candidate. These recommendations should be submitted in writing to the Company, Attn: Secretary, Camber Energy, Inc., 404 Broadway,15915 Katy Freeway, Suite 425, San Antonio,450 Houston, Texas 77067.77094. The proposing stockholder should also include his or her contact information and a statement of his or her share ownership. The Committee may request further information about stockholder recommended nominees in order to comply with any applicable laws, rules, the Company’s Bylaws or regulations or to the extent such information is required to be provided by such stockholder pursuant to any applicable laws, rules or regulations.

Compensation of Directors.Directors.

The following table sets forth compensation information with respect to our non-executive directors during our fiscal yearyears ended December 31, 2021 and March 31, 2017.2020.

| Name | Fees Earned or Paid in Cash ($)* | Option Awards ($) | All Other ($) | Total ($) | ||||||||||||

| Anthony C. Schnur (1) | $ | — | $ | — | $ | — | $ | — | ||||||||

| Richard N. Azar | $ | 16,500 | $ | — | $ | 60,000 | $ | 76,500 | ||||||||

| Alan W. Dreeben (2) | $ | 11,667 | $ | — | $ | — | $ | 11,667 | ||||||||

| Robert D. Tips (2) | $ | 11,667 | $ | — | $ | — | $ | 11,667 | ||||||||

| Fred S. Zeidman (3) | $ | 25,000 | $ | — | $ | — | $ | 25,000 | ||||||||

| J. Fred Hofheinz (4) | $ | 22,000 | $ | — | $ | — | $ | 22,000 | ||||||||

Name Fiscal Year Fees Earned or Paid in Cash ($)* Option Awards ($) All Other Compensation Total Fred S. Zeidman (1) 2021 2020 James G. Miller (1) 2021 2020 Robert K. Green (1) 2021 2020 $ 53,336 $ - $ - $ 53,336 $ 53,333 $ - $ - $ 53,333 $ 53,336 $ - $ - $ 53,336 $ 53,333 $ - $ - $ 53,333 $ 53,336 $ - $ - $ 53,336 N/A N/A N/A N/A

*The table above does not include the amount of any expense reimbursements paid to the above directors. No directors received any Stock Awards, Non-Equity Incentive Plan Compensation,stock awards, non-equity incentive plan compensation, or Nonqualified Deferred Compensation Earningsnonqualified deferred compensation earnings during the period presented. DoesThe table above does not include perquisites and other personal benefits, or property, unless the aggregate amount of such compensation is more than $10,000.

(1) Mr. Schnur did not receive any additional compensation for his services on the Board of Directors separate than the amount he was paid for services as an officer ofIn 2021 and 2020, the Company as disclosed in the “Executive Compensation” table below. Effective on June 2, 2017, Anthony C. Schnur resigned as Chief Executive Officer and as a member of the Board of Directors of the Company.

(2) Resigned as a member of the Board effective October 6, 2017.

(3) Resigned as a member of the Board effective August 7, 2017.

(4) Effective on April 10, 2017, Fred Hofheinz resigned from the Company’s Board of Directors for personal reasons.

Effective January 1, 2014, the Compensation Committee approved the following cash compensation for the Board of Directors: (a)paid each member of the Board of Directors will be paid $5,000 per calendar quarter ($20,000 per year) for services to thetheir pro rata portion of a $40,000 quarterly Board of Directors; (b)Directors fee in cash, payable in arrears and based on the Chairmannumber of members of the Board of Directors will receive an additional $1,000 per quarter; (c)at the Chairmanend of each calendar quarter (for example if there are three (3) members of the Compensation Committee and Nominating and Governance Committee willBoard of Directors at the end of a calendar quarter, each member would receive an additional $500 per quarter; and (d) the Chairman of the Audit Committee will receive an additional $1,000 per quarter.$13,333 in total compensation for such applicable calendar quarter).

| 16 | ||

| Table of Contents |

Vote Required

Vote Required

The threefour nominees for election as directors at the annual meetingAnnual Meeting who receive the greatest number of votes cast by the stockholders, a plurality, will be elected as our directors. As a result, broker non-votes and abstentions will not be counted in determining which nominees received the largest number of votes cast. You may vote “FOR” all nominees, “AGAINST” all nominees or withhold your vote for any one or more of the nominees.

Board Recommendation

Our Board recommends a vote “FOR” all three nominees to the Board.

Proposal 2

AMENDING ARTICLES OF INCORPORATION TO INCREASE NUMBER OF

SHARES OF AUTHORIZED COMMON STOCK

General

Our Articles of Incorporation, as amended (the “Articles”), currently authorize the issuance of up to 200,000,000 shares of common stock. As of November 24, 2017, 68,850,904 shares of common stock were issued and outstanding and 125,863,749 shares were reserved for issuance with our Transfer Agent under our securities convertible into shares of common stock, leaving 5,285,347 shares of common stock unissued and unreserved. In order to ensure sufficient shares of common stock will be available for issuance by us, the Board has approved, subject to stockholder approval, an amendment to the Articles that increases the number of shares of such common stock authorized for issuance from 200,000,000 to 500,000,000.

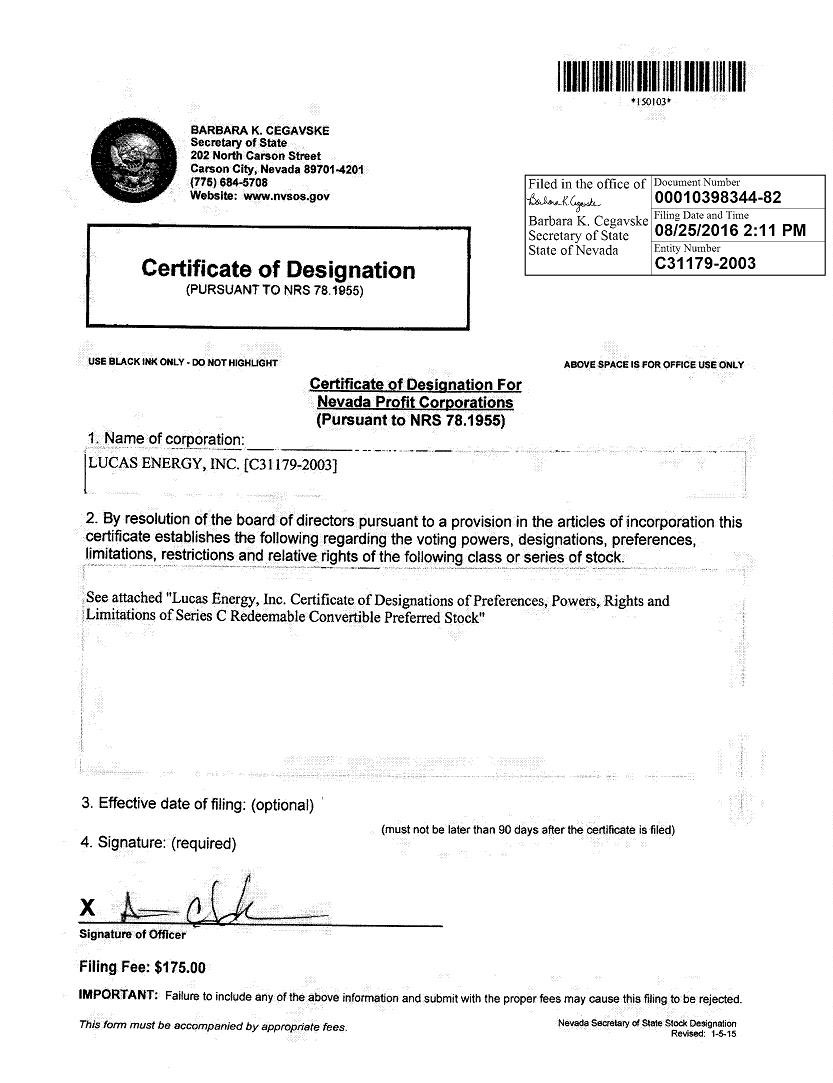

We desire to authorize additional shares of common stock to ensure that enough shares will be available [a] for issuance of shares of common stock upon conversion of currently outstanding convertible securities, including, but not limited to, the shares issuable upon conversion of, including shares issuable for dividends, interest and conversion premiums thereon, the Series C Preferred Stock which we sold and agreed to sell pursuant to the October 2017 Purchase Agreement, and [b] in the event the Board determines that it is necessary or appropriate to (i) raise additional capital through the sale of equity securities, (ii) acquire another company or its assets, (iii) provide equity incentives to employees and officers, (iv) permit future stock splits in the form of stock dividends or (v) satisfy other corporate purposes. The availability of additional shares of common stock is particularly important in the event that the Board needs to undertake any of the foregoing actions on an expedited basis and thus to avoid the time and expense of seeking stockholder approval in connection with the contemplated issuance of common stock. See also the table beginning on page 18 for summary information regarding the number of shares of common stock exceeding our total authorized common stock which we would need to issue assuming the complete conversion/exercise of all of our outstanding convertible securities.

The increase in authorized common stock will not have any immediate effect on the rights of existing stockholders. However, the Board will have the authority to issue authorized common stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or the NYSE American. For example, the rules of the NYSE American require that we obtain stockholder approval prior to the issuance of shares of common stock in a private financing at a price less than the greater of the book value or market value of our common stock, where the total number of shares which may be issued pursuant to such transactions exceeds 20% of the outstanding common stock prior to issuance. To the extent that additional authorized shares are issued in the future, they may decrease the existing stockholders’ percentage equity ownership and, depending on the price at which they are issued, could be dilutive to the existing stockholders.

The amendment is not presently intended for the purposes of effecting an anti-takeover device and is not proposed in response to any specific takeover threat known to the Board. Furthermore, this proposal is not part of any plan by the Board to adopt anti-takeover devices, and the Board currently has no present intention of proposing anti-takeover measures in the near future.

The holders of common stock have no preemptive rights and the Board has no plans to grant such rights with respect to any such shares.

The form of the proposed amendment to our Articles of Incorporation to effect the increase in authorized shares of common stock will be in substantially the form as attached to this proxy statement as Appendix A.

No Appraisal Rights

Under Nevada law, our stockholders are not entitled to appraisal rights with respect to the increase to the number of authorized shares of common stock.

Vote Required

The affirmative vote of the holders of a majority of our outstanding voting shares entitled to vote at the meeting is required to approve this proposal. Abstentions will have the same effect as shares voted against this proposal. Because brokers do not have discretionary authority to vote on this proposal, broker non-votes will have the same effect as shares voted against this proposal. For the approval of this proposal, you may vote “FOR” or “AGAINST” or abstain from voting.

Board Recommendation

Our Board recommends that you vote “FOR” the adoption of the amendment to the Articles to increase the number of shares of authorized common stock.

Proposal 3

APPROVAL OF AUTHORITY FOR THE BOARD TO AFFECT REVERSE STOCK SPLIT

Our Board has approved and has recommended that our stockholders approve a proposal to amend our Articles of Incorporation to authorize our Board to effect a reverse stock split of all of our outstanding common stock at a ratio of between one-for-ten and one-for-fifty (the “Exchange Ratio”), with our Board having the discretion as to whether or not the reverse split is to be effected, and with the exact Exchange Ratio of any reverse split to be set at a whole number within the above range as determined by our Board in its sole discretion, provided that all fractional shares as a result of the split shall be automatically rounded up to the next whole share (the “Reverse Stock Split”). The proposal provides that our Board will have sole discretion to elect, at any time before the earlier of (a) the one year anniversary of this annual meeting; and (b) the date of our 2019 annual meeting of stockholders, as it determines to be in our best interest, whether or not to effect the Reverse Stock Split, and, if so, the number of our shares of common stock within the Exchange Ratio which will be combined into one share of our common stock.

The determination as to whether the Reverse Stock Split will be effected and, if so, pursuant to which Exchange Ratio, will be based upon those market or business factors deemed relevant by the Board at that time, including, but not limited to:

● listing standards under the NYSE American, including the October 5, 2017, notification (the “Deficiency Letter”) received from the NYSE American that we were not in compliance with certain NYSE American continued listing standards and indicating that the Company’s securities have been selling for a low price per share for a substantial period of time and most recently the average price of the Company’s common stock had been below $0.20 on a 30-day average price as of October 5, 2017. Pursuant to Section 1003(f)(v) of the NYSE American Company Guide, the NYSE American staff determined that the Company’s continued listing is predicated on it effecting a reverse stock split of its common stock or otherwise demonstrating sustained price improvement within a reasonable period of time, which the staff determined to be until April 5, 2018;

● existing and expected marketability and liquidity of the Company’s common stock;

● prevailing stock market conditions;

● the historical trading price and trading volume of our common stock;

● the then prevailing trading price and trading volume of our common stock and the anticipated impact of the reverse split on the trading market for our common stock;

● the anticipated impact of the reverse split on our ability to raise additional financing;

● business developments affecting the Company;

● the Company’s actual or forecasted results of operations; and

● the likely effect on the market price of the Company’s common stock.

Our Board of Directors recommends a vote “FOR” all four nominees to the Board of Directors.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

General

The Audit Committee has selected Turner to audit our consolidated financial statements for the fiscal year ending December 31, 2022. Turner has been our independent registered public accounting since September 21, 2021. We are asking the stockholders to ratify the appointment of Turner as our independent registered public accounting firm for the fiscal year ending December 31, 2022. Turner was appointed by the Audit Committee in accordance with its charter.

In the event stockholders fail to ratify the appointment, the Audit Committee may reconsider this appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s and our stockholders’ best interests.

The Company does not anticipate a representative from Turner to be present at the annual stockholders meeting. In the event that a representative of Turner is present at the Annual Meeting, the representative will have the opportunity to make a statement if he/she desires to do so and the Company will allow such representative to be available to respond to appropriate questions.

The Audit Committee has approved all services provided by Turner and Marcum LLP (“Marcum”). Representatives of Turner do not plan to attend the Annual Meeting.

| 17 |

| Table of Contents |

Change in Independent Auditors

As disclosed in the Company’s Current Report on Form 8-K filed with the SEC on September 22, 2021, we dismissed Marcum on September 16, 2021 as our independent auditor. We engaged Turner on September 21, 2021 as our independent public accounting firm to audit our consolidated financial statements for the year ended December 31, 2021 and to re-audit our consolidated financial statements for the years ended March 31, 2020 and March 31, 2019, and for the transition period ended December 31, 2020, which had previously been audited by Marcum. The audited financial statements included in the Annual Reports on Form 10-K for the years ended December 31, 2021 and March 31, 2020 were audited by Turner.

During the Company’s prior fiscal years ended March 31, 2020 and March 31, 2019, the transition period ended December 31, 2020, and through September 16, 2021, there were no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) with Marcum on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Marcum, would have caused Marcum to make reference to the matter in its report on the consolidated financial statements for such year.

Audit Fees

The aggregate fees billed by our independent auditor, Turner, and our former independent auditor, Marcum, for professional services rendered for the audit of our annual financial statements included in our Annual Reports on Form 10-K for the years ended December 31, 2021 and March 31, 2020, and for the review of quarterly financial statements included in our Quarterly Reports on Form 10-Q for the quarters ending March 31, June 30, September 30, and December 31, 2021 and 2020, were:

2021 2020 Turner Marcum $ 145,000 $ - $ 495,505 $ 323,100

We do not use the auditors for financial information system design and implementation. Such services, which include designing or implementing a system that aggregates source data underlying the financial statements or that generates information that is significant to our financial statements, are provided internally or by other service providers. We do not engage the auditors to provide compliance outsourcing services.

The Audit Committee has considered the nature and amount of fees billed by Turner believes that stockholder approval granting us discretionthe provision of services for activities unrelated to set the actual exchange ratio withinaudit is compatible with maintaining Turner’s independence.

| 18 |

| Table of Contents |

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by the rangeindependent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The Audit Committee may delegate the authority to pre-approve the retention of the Exchange Ratio, rather than stockholder approvalindependent registered public accounting firm for permitted non-audit services to one or more members of a specified exchange ratio, provides us with maximum flexibilitythe committee, provided that such persons are required to reactpresent the pre-approval of any permitted non-audit service to then-current market conditions and volatility in the market pricecommittee at the next meeting following any such pre-approval. None of our common stock in orderthe fees paid to set an exchange ratio that is intended to result in a stock price in excess of $0.20 per share to avoid continuing to be considered a low priced stockthe independent registered public accounting firm under the category Audit Fees described above were approved by the NYSE American,committee after services were rendered pursuant to the de minimis exception established by the SEC.

Audit Committee Report

The Audit Committee represents and therefore, isassists the Board of Directors in fulfilling its responsibilities for general oversight of the best interestsintegrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications and independence, the performance of the Company’s internal audit function and independent registered public accounting firm, and risk assessment and risk management. The Audit Committee manages the Company’s relationship with its independent registered public accounting firm (which reports directly to the Audit Committee). The Audit Committee has the authority to obtain advice and assistance from outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties and receives appropriate funding, as determined by the Audit Committee, from the Company for such advice and assistance.

In connection with the fiscal years 2020 and 2021 audited financial statements of the Company, and its stockholders. However, there can be no assurance that the Reverse Stock Split will result in our common stock trading above $0.20 for any significant periodAudit Committee of time. If the Board determines to implement the Reverse Stock Split, we intend to issue a press release announcing the terms and effective dateof Directors of the Reverse Stock Split before we fileCompany (1) reviewed and discussed the Amendmentaudited financial statements with the Secretary of State of the State of Nevada.

If our Board determines that effecting the Reverse Stock Split is in our best interest, the Reverse Stock Split will become effective upon the filing of an amendment to our Articles of IncorporationCompany’s management; (2) discussed with the Secretary of State ofCompany’s independent auditors the State of Nevada. The form of the proposed amendment to our Articles of Incorporation to effect the Reverse Stock Split will be in substantially the form as attached to this proxy statement as Appendix B (the “Amendment”). The Amendment filed thereby will set forth the number of sharesmatters required to be combined into one sharediscussed by the Statement on Auditing Standards No. 61, as amended (Codification of our common stock withinStatements on Auditing Standards, AU 380), as adopted by the limits set forthPublic Company Accounting Oversight Board (“PCAOB”) in this proposal but will not have any effect onRule 3200 and Exchange Act Regulation S-X, Rule 2-07; (3) received the number of shares of common stock or preferred stock currently authorized,written disclosures and the ability of our Board to designate preferred stock, the par value of our common or preferred stock, or any series of preferred stock previously authorized (except to the extent such Reverse Stock Split adjusts the conversion ratio of such previously designated preferred stock).

Purpose of the Reverse Stock Split

The primary purpose of the Reverse Stock Split is to increase proportionately the per share trading price of our common stock. Our common stock is listed on the NYSE American under the symbol “CEI”. Under the NYSE American’s listing standards, if the exchange considers our common stock to be a low-priced stock (generally trading below $0.20 per share for an extended period of time), our common stock could be subject to a delisting notification, which notification we received on October 5, 2017, as discussed above. Additionally, if at any time our common stock trades below $0.06 per share, we will be automatically delistedletter from the NYSE American. Our common stock has not traded above $1 per share since February 10, 2017, and has not traded above $0.30 per share since July 19, 2017, and our price per share has ranged from a low of $0.14 per share to a high of $1.75 per share for the twelve month period ended November 24, 2017. To regain compliance with applicable NYSE American listing standards asindependent auditors required by the Deficiency Letter, we need to effect a reverse stock splitapplicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committee concerning independence; (4) discussed with the independent auditors the independent auditors’ independence; and (5) considered whether the provision of non-audit services by April 5, 2018.the Company’s principal auditors is compatible with maintaining auditor independence.

As noted above, if we were unableBased upon these reviews and discussions, the Audit Committee recommended to regain compliance with NYSE American low-priced listing standards in the appropriate time, we could be subject to delisting. Delisting could have a material adverse effect on our business, liquidity and on the trading of our common stock. If our common stock were delisted, our common stock could be quoted on the OTCQB market or on the “pink sheets” maintained by the OTC Markets Group. However, such alternatives are generally considered to be less efficient markets. Further, delisting from the NYSE American could also have other negative effects, including potential loss of confidence by partners, lenders, suppliers and employees and could also trigger various defaults under our lending agreements and other outstanding agreements. Finally, delisting could make it harder for us to raise capital and sell securities as we would no longer be eligible to use Form S-3 short form registration statements for such purposes.

We also believe that the increased market price of our common stock expected as a result of implementing the Reverse Stock Split may improve the marketability and liquidity of our common stock and encourage interest and trading in our common stock. Because of the trading volatility often associated with low-priced stocks, many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. Although it should be noted that the liquidity of our common stock may be harmed by the Reverse Stock Split given the reduced number of shares that would be outstanding after the Reverse Stock Split, our Board is hopeful that the anticipated higher market price will offset, to some extent, the negative effects on the liquidity and marketability of our common stock inherent in some of the policies and practices of institutional investors and brokerage houses described above.

Board of Directors, Discretion to Implement the Reverse Stock Split

If proposal 3 is approved by our stockholders, the Reverse Stock Split will be effected, if at all, only upon a determination byand the Board of Directors approved, that the Reverse Stock Split isaudited financial statements for fiscal years 2020 and 2021 be included in the best interests of the Company and its stockholders. The Board’s determination as to whether the Reverse Stock Split will be effected and, if so, at which Exchange Ratio, will be based upon certain factors, including existing and expected marketability and liquidity of our common stock, prevailing stock market conditions, business developments affecting us, actual or forecasted results of operations and the likely effectCompany’s Annual Reports on the market price of our common stock, and the listing standards of the NYSE American. If the Board does not act to implement the Reverse Stock Split prior to the earlier of (a) the one year anniversary of this annual meeting; and (b) the date of our 2019 annual meeting of stockholders, the authorization granted by stockholders pursuant to this proposal 3 would be deemed abandoned and without any further effect. In that case, the Board may again seek stockholder approval at a future dateForm 10-K for the Reverse Stock Split if it deems it to be advisable.

Effect of the Reverse Stock Split

If approved by our stockholdersfiscal years ended December 31, 2021 and implemented by the Board, as of the effective time of the Amendment, each issued and outstanding share of our common stock would immediately and automatically be reclassified and reduced into a fewer number of shares of our common stock, depending upon the Exchange Ratio selected by the Board, which could range between one-for-ten and one-for-fifty, provided that all fractional shares as a result of the split shall be automatically rounded up to the next whole share.

Except to the extent that the Reverse Stock Split would result in any stockholder receiving an additional whole share of common stock in connectionMarch 31, 2020 for filing with the rounding of fractional shares or any dilution to other stockholder in connection therewith, as described below, the Reverse Stock Split will not:

● affect any stockholder’s percentage ownership interest in us;

● affect any stockholder’s proportionate voting power;

● substantially affect the voting rights or other privileges of any stockholder; or

● alter the relative rights of common stockholders, preferred stockholders, warrant holders or holders of equity compensation plan awards and options.

Depending upon the Exchange Ratio selected by the Board, the principal effects of the Reverse Stock Split are:

● the number of shares of common stock issued and outstanding will be reduced by a factor ranging between ten and fifty, notwithstanding any rounding;

● the per share exercise price will be increased by a factor between ten and fifty, and the number of shares issuable upon exercise shall be decreased by the same factor, for all outstanding options, warrants and other convertible or exercisable equity instruments entitling the holders to purchase shares of our common stock;

● the number of shares authorized and reserved for issuance under our existing equity compensation plans will be reduced proportionately; and

● the conversion rates for holders of our preferred stock and other outstanding securities will be adjusted proportionately.SEC.

The following table contains approximate information relating to our outstanding common stock, Series B Preferred Stock (which converts into common stock priorundersigned members of the Audit Committee have submitted this Report to the Reverse Stock Split in a ratioBoard of 7.1428571-for-1), Series C Preferred Stock [not including shares agreed to be sold, but which haven’t been sold to date to the Investor under the October 2017 Purchase Agreement], the debenture and warrant held by the Investor, including shares issuable for dividends and conversion premiums thereon, our outstanding warrants and outstanding options under our stock plans, under various proposed exchange ratio options, based on our current authorized shares of common stock and the number of authorized shares assuming proposal 2 above is approved:

| Assuming a Reverse Split of*: | ||||||

| Pre Reverse Split | 1 for 10 | 1 for 20 | 1 for 30 | 1 for 40 | 1 for 50 | |

| Outstanding Common Stock | 68,850,904 | 6,885,091 | 3,442,546 | 2,295,031 | 1,721,273 | 1,377,019 |

| Issuable upon the exercise of outstanding warrants to purchase shares of common stock (not including the Investor’s Warrant) | 215,148 | 21,515 | 10,758 | 7,172 | 5,379 | 4,303 |

| Issuable upon the exercise of outstanding options to purchase shares of common stock | 5,920 | 592 | 296 | 198 | 148 | 119 |

| Issuable upon conversion of our outstanding Series B Convertible Preferred Stock | 2,917,914 | 291,792 | 145,896 | 97,264 | 72,948 | 58,359 |

| Issuable upon conversion of outstanding Series C Preferred Stock and a debenture and warrant held by the Investor, including shares issuable for dividends and conversion premiums thereon (1)(2) | 383,835,484 | 38,383,549 | 19,191,775 | 12,794,517 | 9,595,888 | 7,676,710 |

| Reserved for issuance under Equity Incentive Plans | 930,841 | 93,085 | 46,543 | 31,029 | 23,272 | 18,617 |

| Total shares outstanding and reserved and required for issuance upon conversion of outstanding convertible securities | 456,756,211 | 45,675,624 | 22,837,814 | 15,225,211 | 11,418,908 | 9,135,127 |

| Current Authorized Common Stock | 200,000,000 | 200,000,000 | 200,000,000 | 200,000,000 | 200,000,000 | 200,000,000 |

| Shares available for future issuance with current authorized shares of common stock | (256,756,211) | 154,324,376 | 177,162,186 | 184,774,789 | 188,581,092 | 190,864,873 |

| Authorized common stock assuming the approval of proposal 2 above | 500,000,000 | 500,000,000 | 500,000,000 | 500,000,000 | 500,000,000 | 500,000,000 |

| Shares available for future issuance assuming the approval of proposal 2 above and the increase in our authorized shares of common stock to 500,000,000 shares | 43,243,789 | 454,324,376 | 477,162,186 | 484,774,789 | 488,581,092 | 490,864,873 |

Directors.

(1) Not including any additional shares of Series C Preferred Stock which we have agreed to sell under the October 2017 Purchase Agreement.AUDIT COMMITTEE

James G. Miller, Chairman

(2) Approximate.

* Does not take into account the rounding of fractional shares described below under “Fractional Shares”.Fred S. Zeidman

| 19 | ||

| Table of Contents |

Additionally, the below table sets forth the weighted average exercise price of (i) outstanding options; (ii) outstanding warrants; and (iii) the conversion ratio of our Series B Preferred Stock under various reverse split ratios:

Pre Reverse Split |

1 for 10 |

1 for 20 |

1 for 30 |

1 for 40 |

1 for 50 | |

| Weighted Average Exercise Price of Outstanding Warrants* | $3.90 | $39.00 | $78.00 | $117.00 | $156.00 | $195.00 |

| Weighted Average Exercise Price of Outstanding Options | $44.32 | $443.20 | $886.40 | $1,329.60 | $1,772.80 | $2,216.00 |

| Conversion Ratio of Series B Preferred Stock into Common Stock (X for 1) | 7.1428571 | 0.7142857 | 0.3571429 | 0.2380952 | 0.1785714 | 0.1428571 |

* Not including warrants heldThe foregoing report is not soliciting material, is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Investor.

IfCompany under the Reverse Stock Split is implemented, the Amendment will not reduce the numberSecurities Act of shares of our common stock or preferred stock authorized under our Articles of Incorporation,1933, as amended, the right of our Board to designate preferred stock, the par value of our common or preferred stock, or otherwise effect our designated series of preferred stock, except to affect the exchange ratio thereof (as shown in the table above).

Our common stock is currently registered under Section 12(b) of the Exchange Act, and we are subject to the periodic reporting and other requirements thereof. We presently do not have any intent to seek any change in our status as a reporting company under the Exchange Act eitherwhether made before or after the Reverse Stock Split.date hereof and irrespective of any general incorporation language in any such filing.

Additionally, as of the date of this proxy statement, we do not have any current plans, agreements, or understandings with respect to the additional authorized shares that will become available for issuance after the Reverse Stock Split has been implemented.

Fractional Shares

Stockholders will not receive fractional shares in connection with the Reverse Stock Split. Instead, stockholders otherwise entitled to fractional shares will receive an additional whole share of our common stock. For example, if the Board effects a one-for-fifty split, and you held nine shares of our common stock immediately prior to the effective date of the Amendment, you would hold one share of the Company’s common stock following the Reverse Stock Split.

Effective Time and Implementation of the Reverse Stock SplitVote Required

The effective timeapproval of the ratification of the appointment of Turner as our independent registered public accounting firm for the Reverse Stock Split will be the date on which we file the Amendment with the office of the Secretary of State of the State of Nevada or such later date and time as specified in the Amendment, provided that the effective date must occur prior to the earlier of (a) the onefiscal year anniversary of this annual meeting; and (b) the date of our 2019 annual meeting of stockholders.

Holders of pre-reverse split shares (“Old Shares”), after the effective date, may, but are not required to, contact our transfer agent regarding the procedure for surrendering to our transfer agent, certificates representing pre-reverse split shares in exchange for certificates representing post-reverse split shares (“New Shares”). No new certificates will be issued to a stockholder until or unless such stockholder has surrendered such stockholder’s outstanding certificate(s) together with such information, fees and documentation as the transfer agent may require, to the transfer agent for reissuance. Stockholders should not destroy any stock certificate. We and the transfer agent will adjust record stockholder’s shareholdings in our records regardless of whether any certificates evidencing Old Shares are returned for reissuance in order to evidence New Shares and therefore, stockholders are not required to return their certificates for reissuance unless they want to. In the event stockholders do not have their certificates representing Old Shares reissued for certificates evidencing New Shares, such certificates will still only provide rights and ownership of the adjusted number of New Shares in connection with the Reverse Stock Split, when presented for voting or transfer, even if the certificates still list the number of Old Shares prior to the Reverse Stock Split.

Stockholders whose shares are held in book-entry form or by their stockbroker do not need to submit old share certificates for exchange. These stockholders’ book-entry records or brokerage accounts will automatically reflect the new quantity of shares based on the selected Reverse Stock Split ratio.

Beginning on the effective date of the Reverse Stock Split, each certificate or other share ownership record representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares, subject to the rounding up of fractional shares to the next whole share.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCKCERTIFICATE(S) UNLESS REQUESTED TO DO SO

No Going-Private Transaction

Notwithstanding the decrease in the number of outstanding shares following the proposed Reverse Stock Split, our board or directors does not intend for the Reverse Stock Split to be the first step in a “going-private transaction” within the meaning of Rule 13e-3 of the Exchange Act. In fact, since all fractional shares of common stock resulting from the Reverse Stock Split will be rounded up to the nearest whole share, there will be no reduction in the number of stockholders of record that could provide the basis for a going-private transaction.

Accounting Matters

The Reverse Stock Split will not affect the par value of our common stock ($0.001 per share). However, at the effective time of the Reverse Stock Split, the stated capital attributable to common stock on our balance sheet will be reduced proportionately based on the Exchange Ratio (including a retroactive adjustment of prior periods), and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. Reported per share net income or loss would be expected to be proportionally higher because there will be fewer shares of our common stock outstanding.

No Appraisal Rights

Under the Nevada Revised Statutes, our stockholders are not entitled to appraisal rights with respect to the Reverse Stock Split.

Certain Risks Associated with the Reverse Stock Split

Before voting on this proposal 3, you should consider the following risks associated with the implementation of the Reverse Stock Split:

● The price per share of our common stock after the Reverse Stock Split may not reflect the Exchange Ratio implemented by the Board and the price per share following the effective time of the Reverse Stock Split may not be maintained for any period of time following the Reverse Stock Split. For example, based on the closing price of our common stock on November 24, 2017 of $0.1964 per share, if the Reverse Stock Split was implemented at an Exchange Ratio of 1-for-10, there can be no assurance that the post-split trading price of the Company’s common stock would be $1.964 or even that it would remain above the pre-split trading price. Accordingly, the total market capitalization of our common stock following a Reverse Stock Split may be lower than before the Reverse Stock Split.

● Following the Reverse Stock Split, we may still run the risk of being considered a low priced stock under the listing standards of the NYSE American, which could cause the Company to be delisted or subject to delisting.

● Effecting the Reverse Stock Split may not attract institutional or other potential investors, or result in a sustained market price that is high enough to overcome the investor policies and practices, and other issues relating to investing in lower priced stock described in “Purpose of the Reverse Stock Split” above.

● The trading liquidity of our common stock could be adversely affected by the reduced number of shares outstanding after the Reverse Stock Split.

● If a Reverse Stock Split is implemented by the Board, some stockholders may consequently own less than 100 shares of our common stock. A purchase or sale of less than 100 shares (an “odd lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own fewer than 100 shares following the Reverse Stock Split may be required to pay higher transaction costs if they should then determine to sell their shares of the Company’s common stock.

● A stockholder who receives a “round up” from a fractional share to a whole share may have a tax event based on the value of the “rounded up” share provided to the stockholder. The Company believes such tax event will be minimal or insignificant for most stockholders.

Potential Anti-Takeover Effect

The increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of our Board or contemplating a tender offer or other transaction for our combination with another company). However, the Reverse Stock Split proposal is not being proposed in response to any effort of which we are aware to accumulate shares of our common stock or obtain control of our Company, nor is it part of a plan by management to recommend a series of similar amendments to our Board and stockholders.

Federal Income Tax Consequences of the Reverse Stock Split

A summary of the federal income tax consequences of the proposed Reverse Stock Split to individual stockholders is set forth below. It is based upon present federal income tax law, which is subject to change, possibly with retroactive effect. The discussion is not intended to be, nor should it be relied on as, a comprehensive analysis of the tax issues arising from or relating to the proposed Reverse Stock Split. In addition, we have not requested and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of the proposed Reverse Stock Split. Accordingly, stockholders are advised to consult their own tax advisors for more detailed information regarding the effects of the proposed Reverse Stock Split on them under applicable federal, state, local and foreign income tax laws.

● We believe that the Reverse Stock Split will be a tax-free recapitalization for federal income tax purposes. Accordingly, a stockholder will generally not recognize any gain or loss as a result of the receipt of the post-reverse split common stock pursuant to the Reverse Stock Split. However, a stockholder who receives a “round up” from a fractional share to a whole share may have a tax event based on the value of the “rounded up” share provided to the stockholder. The Company believes such tax event will be minimal or insignificant for most stockholders.

● The shares of post-reverse split common stock in the hands of a stockholder will have an aggregate basis for computing gain or loss equal to the aggregate basis of the shares of pre-reverse split common stock held by that stockholder immediately prior to the Reverse Stock Split.

● A stockholder’s holding period for the post-reverse split common stock will include the holding period of the pre-reverse split common stock exchanged.

Recommendation of the Board of Directors

The Board recommends that you vote “FOR” the amendment to our Articles of Incorporation and the authorization of the Board of the Company, without further stockholder approval, to amend the Company’s Articles of Incorporation, at any time prior to the earlier of (a) the one year anniversary of this annual meeting; and (b) the date of our 2019 annual meeting of stockholders, to effect a reverse stock split of our outstanding common stock in a ratio of between one-for-ten and one-for-fifty, provided that all fractional shares as a result of the split shall be automatically rounded up to the next whole share, in accordance with this proposal 3. Unless you specify otherwise, the Board intends the accompanying proxy to be voted for this proposal 3.

Vote Required

The approval of this Proposal 3ending December 31, 2022 requires the affirmative vote of the holders of a majority of the shares represented at the meeting, in person or by proxy, and entitled to vote. As a result, abstentions will have the same practical effect as votes against this Proposal. Broker non-votes will have no effect on the outcome of this Proposal. However, because brokers generally have discretionary authority to vote on the ratification of our independent auditors, broker non-votes are generally not expected to result from the vote on this Proposal. For the approval of the ratification of the appointment of Turner, you may vote “FOR” or “AGAINST” or abstain from voting.

Board Recommendation

Our Board of Directors recommends that you vote “FOR” the ratification of appointment of Turner as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section 14A of the Exchange Act and the related rules of the SEC, we are including in this proxy statement a separate proposal, which gives our stockholders the opportunity to approve or not approve the compensation of our Named Executive Officers (as disclosed in this proxy statement) by voting for or against the resolution below (commonly referred to as “Say-on-Pay”). While our Board of Directors and Compensation Committee intend to carefully consider the stockholder vote resulting from the proposal, the final vote will not be binding on us and is advisory in nature.

In considering their vote, stockholders are encouraged to review with care the information regarding our executive compensation program as discussed under “Named Executive Officer Compensation” (beginning on page 24), and the accompanying compensation tables and narratives.

| 20 |

| Table of Contents |